Where Next, Now? Postgraduate Audiences and Destinations in a Shifting Landscape

The topic is right there in my title: an overview of what Keystone's unique combination of search and survey data can tell us about the prospective postgraduate audiences FindAUniversity specialise in.

In fact, I had such a great time talking about this that I couldn't actually work out how to end and leave the webinar* – a 'blooper' that's available to view along with the full recording.

But, if you'd prefer a quick recap of the main points, I've picked out three below.

*We'll blame excitement rather than my just being fairly rusty with Zoom.

1) Policy clarity matters as much as policy direction

If you're considering studying abroad in Australia, Canada, the UK or the USA right now, one or more of those countries is changing:

- How much it costs to study there – via changes to visa and application fees, or to the amount of money ('proof of funds') you need to have available in advance

- What you can do after you study there – via changes to post-study work visa entitlements and duration

- Whether you can actually come to study there – via setting enrolment caps or changing (and in some cases halting) application processes

It's is a lot to follow and it all shapes whether you feel welcome to study there.

And that's where my point about policy clarity (and wider narrative) comes in. Here's what our Keystone Share of Search data (so, relative interest on our platforms) looks like across the Big 4 at Masters and PhD level in Q3*:

It's probably not surprising to see the USA doing so poorly (and this is a trend Keystone Education Group have been helping to follow in wider media) and the performance of Australia and Canada reflect the impact of visa caps put in place to varying extents over the past year or so (with the impact visible in applications and processing).

So why is the UK doing so well, a year out from a dependent ban for Masters students, several visa and healthcare fee increases and a stated policy to cut the duration of the Graduate Route post-study work visa by 25%?

I actually think the answer lies in that phrase "stated policy". For all the change the UK has made, the direction of travel has been relatively clear (certainly relative to elsewhere) and whilst the UK Government is focusing on quality and scrutiny of international students it's also been explicit that it likes and welcomes them. And international students appreciate that.

Prospective student audiences can deal with some change to the status quo, but there has to still be a status quo. The UK is doing relatively well on that front right now and we see this in our data.

*Q3 being through to 15 September. I actually walked through Qs 1-3 in the recorded session, but for simplicity here I've just shown 'where we are now'

2) The USA is still very popular

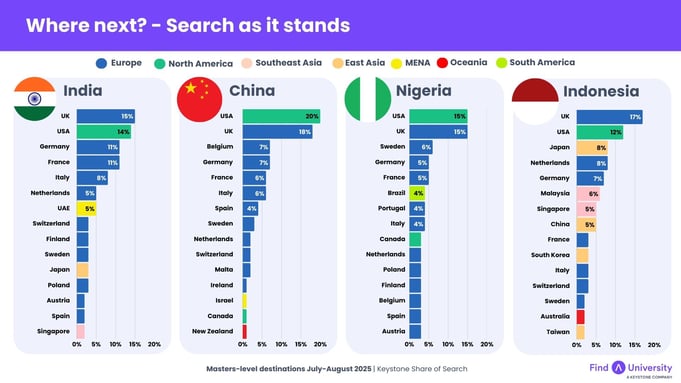

You can see that very clearly when we break things down across some big audiences:

The above is data for the most-searched study destinations for Indian, Chinese, Nigerian and Indonesian audiences at Masters level in Keystone data for July-August.

It's a two-horse race for positions one and two and the USA wins in two out of four (try saying that quickly over a Canva deck).

US interest is falling, to some extent, from pretty much all of these audiences (as I explore in the webinar) and patterns vary. But it's still really popular. People still want to study abroad in the USA.

3) Some audiences are much more regional

But look how different its destination profile is compared to India, Nigeria and China. Yes, Europe does well across all, but Indonesia is where we see strong interest in East and Southeast Asia (and that's actually all the more impressive given some of the small biases* in our audience makeup).

This is going to be more important as global study abroad evolves and we see more intra-regional mobility, something we've covered in several ways on the main Keystone blog recently, with respect to trends for Asia, Africa and Trans-National Education.

*Our Share of Search data model means we only measure real change in what audiences actually search for, but (as I will always acknowledge) our strong listings coverage in Europe and North America can shape what audiences come to us to seek.

4) Perception matters, but it's shaped by information

We've recently added a question to our always-on Keystone Pulse survey, asking people to rate their stated study destination according to a range of factors. This has fast become my colleague, Jack's, favourite question and it therefore had to go into the webinar:

What we see here is the percentage of people who rate a country as 'very good' for a given factor, after having already decided to study there. So yes, this may as well be called "Confirmation Bias: The Chart."

But it's interesting because of that.

The UK and USA win on academic factors – perceptions of subject offering and reputational quality, whilst doing worse on affordability and safety and political climate.

The other data varies. Do audiences really think France and Italy have a relatively poor subject offering? Or that the cost of living as a student in Australia is much better than in Ireland? No, not necessarily. The question doesn't ask for comparison and where something isn't 'very positive' it's often simply 'quite positive' or 'uncertain'.

What I think this does show us is the relationship between perception and information. There's a prevailing narrative that the UK and USA are good and expensive and we see that reflected in data coming back from students. Are there other narratives about other destinations we should make more prevalent? Perhaps.

In which ending a blog is easier than ending a Zoom

We live – and work – in interesting times. More power to anyone reading this and doing that work.